When the World Stops Talking About India and Starts Talking to India

For decades, India was described as a “future opportunity.” Yes, India is a large market; however, it is also an emerging strategic partner. A strategic partner, perhaps but with caution. Then something changed. Two successive deals: Mother of All Deals and Bilateral Trade Agreement was signed.

- When the World Stops Talking About India and Starts Talking to India

- The Global Backdrop: Why Trade Has Become A Pressure Tool ?

- The “Mother of All Deals”: The India–EU Free Trade Agreement

- Why Mother of All Deals Is Been Taken Seriously ?

- Impact of Mother of All Deals

- Decoding the Mother of All Deals Across Sectors

- Mother of All Deals in Defense Sector: The Indirect but Crucial Link

- What Europe Gains from Mother of All Deals and Why It Matters ?

- The U.S. Interim Bilateral Trade Framework

- What This India-US Trade Framework Actually Represents?

- Defense Cooperation: A Real Strategic Layer of the U.S. Framework

- Why Technology Transfer Changes the Equation?

- Defense Pricing After the Deals: What Actually Improved?

- Zero-Tariff Export Access: Ground-Level Economic Impact

- The Tariff Asymmetry Question?

- Why India Offered 0% Tariffs ?

- Why the U.S. Retained ~18% Tariffs ?

- Why Is This Asymmetry Strategic and Not Submissive ?

- Why India accepted the $500 Bn Commitment ?

- How India Turned Inevitable Spending into Leverage?

- How India Turned Inevitable Spending into Leverage?

- Why This Strengthens India Long-Term ?

- India’s Strategic Position: Has the Leverage Shifted ?

- Pros, Cons, and Reality Checks of Mother of All Deals and Bilateral Trade Agreement

- Strategic Roadmap: What India Should Prioritize?

- Conclusion: What Mother of All Deals and Bilateral Trade Agreement Really Signal?

- Top 4 FAQs: Mother of All Deals vs Bilateral Trade Agreement

Within less than a year, India had concluded Europe’s most ambitious trade agreement in decades. This was achieved while sustaining a stabilized tariff position vis-à-vis the United States without changing their basic strategic stands. In addition to this, they had increased access to defense technology and secured zero-tariff access for their major exports in sectors such as agriculture, pharmaceuticals, and manufactured goods. India, through a subtle way, compelled the major powers to reassess and recalibrate their strategy while navigating with India.

Behind these announcements, there were some figures that immediately triggered debate, and these figures, at first glance, seemed unbalanced and disturbing. Tariffs that did not mirror each other. Market access that looked asymmetric. Commitments that raised eyebrows.

The debates that followed were predictable. One side hailed a masterstroke. Another called it a compromise. Online discourse reduced it to a binary contest: Europe good, America bad or vice versa. But this framing misses the real story. Mother of All Deals and Bilateral Trade Agreement are not trophies. They are instruments. And for the first time in modern history, India is using them from a position of leverage rather than vulnerability.

“India seeks friendship with all, but submission to none.”

Articulated by former Indian PM Atal Bihari Vajpayee, a reminder the world continues to reckon with.

The Global Backdrop: Why Trade Has Become A Pressure Tool ?

Trade policy in the present era no longer operates in alienation and isolation. It is the very core of the development of the following factors:

- National security

- Defense readiness

- Energy access

- Technology control

Tariffs are no longer just economic penalties they are the signals. Supply chains are no longer just logistical systems, they are strategic assets.

Western economies are attempting to achieve three difficult goals simultaneously:

- Reduce dependence on China.

- Maintain industrial competitiveness.

- Preserve geopolitical influence.

This requires a partner with scale, stability, and autonomy. India is not the only option but it is the most viable one.

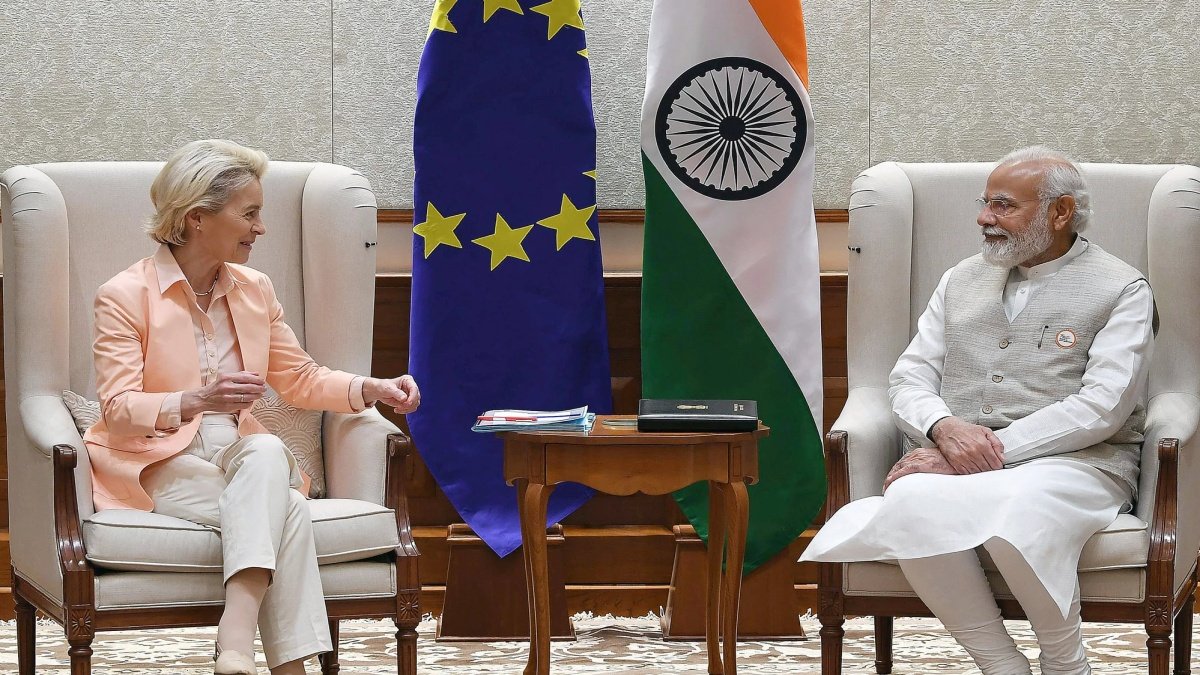

The “Mother of All Deals”: The India–EU Free Trade Agreement

Why Mother of All Deals Is Been Taken Seriously ?

The India–EU FTA (Mother of All Deals) is not headline-driven diplomacy. It is architecture. It spans:

- Industrial goods

- Pharmaceuticals

- Automobiles and components

- Services and skilled mobility

- Investment protection

Unlike symbolic agreements, this one is legally dense and structurally binding.

Impact of Mother of All Deals

Imagine you are running a small business, and your various products, when exported to Europe, face unpredictable fees, paperwork delays, and regulatory uncertainty. This newly signed Mother of All Deals removes most of these frictions permanently, ensuring smooth processes. That translates into:

- Lower final prices for Indian goods in Europe

- Larger and more stable orders

- Confidence to expand production capacity

- Long-term job creation

This is why manufacturing clusters across India responded positively almost immediately.

Decoding the Mother of All Deals Across Sectors

The Mother of All Deals represents a full-scale restructuring of various economic engagements and collaborations in strategic sectors. It focuses on a long-term integration rather than short-term tariff benefits.

Industrial Goods: The agreement cuts several tariffs and some non-tariff barriers, thus improving cost competitiveness for Indian manufactured indigenous goods. Improved regulatory stability supports orders, capacity building, and integration into European manufacturing value chains.

Pharmaceuticals: The deal helps Indian and European drug regulators work better together. So the companies do not have to repeat the same tests and paperwork repeatedly. Although medicines would still be requiring approval, the process becomes clearer and less confusing. This makes it easier for the Indian pharmaceutical companies to sell affordable generic medicines in Europe and strengthens India’s reputation as a dependable supplier of medicines.

Automotive & Auto Components: Tariff cuts and regulatory harmonization improve the competitiveness of Indian auto component suppliers. Over the long term, this helps with collaborative manufacturing and further integrates India into European automotive value chains.

Services & Skilled Mobility: Greater clarity enhances Indian service suppliers’ access to IT, engineering, healthcare, and consulting services. It also helps with sustained cross-border service delivery beyond short-term arrangements.

Investment Protection: Improved and clear legal certainty with dispute resolution mechanisms. It boosts the investors’ confidence, thereby leading to a steady European investment in India’s manufacturing, infrastructure, and technology sectors over the course of time.

The Mother of All Deals, therefore, transforms trade from a transactional to a structural level, locking in permanent changes in the realm of production, investment, and mobility rather than providing temporary tariff gains.

Mother of All Deals in Defense Sector: The Indirect but Crucial Link

Although the EU agreement is not a defense pact, its implications for India’s defense ecosystem are significant. Modern defense platforms depend heavily on the following products like:

- Advanced alloys

- Precision engineering

- Aerospace-grade manufacturing

- Secure digital systems

These are areas where European firms excel. By integrating Indian industry into European production and standards frameworks, the deal:

- Improves quality benchmarks

- Enhances certification access

- Strengthens India’s ability to absorb high-end defense technologies

This is how civilian trade quietly feeds military capability.

What Europe Gains from Mother of All Deals and Why It Matters ?

Europe is not acting out of generosity. It gains:

- Access to India’s growth market

- Supply chain diversification

- A democratic production partner

- Reduced overreliance on East Asia especially China

This deal is as much about Europe’s strategic resilience as India’s export growth.

The U.S. Interim Bilateral Trade Framework

The U.S.–India trade relationship entered turbulence when punitive tariffs were imposed, partly linked to India’s energy purchases and trade balances.

India faced a choice:

- Adjust strategic decisions under pressure, or

- Absorb economic pain and negotiate later.

India deliberately opted and went on for the second option. Markets reacted. Supply chains had strained. Diplomatic channels stayed open. Eventually, the tariffs were rolled back massively, and an interim framework finally emerged.

What This India-US Trade Framework Actually Represents?

It is not a surrender document rather than a reset mechanism. It reduces the immediate friction drastically, restores predictability, and even creates space for a more balanced final agreement. In practical terms, it prevents the economy from bleeding while negotiations continue.

Defense Cooperation: A Real Strategic Layer of the U.S. Framework

This is where the U.S. deal quietly delivers a long-term value. Key areas of progress:

- Aircraft engines and propulsion technologies

- Avionics and electronic warfare systems

- UAV components and sensors

- Radar, surveillance, and secure communications

- Joint production and co-development

These are not off-the-shelf purchases. They are capability enablers.

Why Technology Transfer Changes the Equation?

Importing weapons solves immediate needs. Importing know-how changes future outcomes. Technology transfer allows India to:

- Control upgrades

- Manage maintenance

- Reduction of dependency on foreign supply chains

- Develop indigenous variants over time

This is how defense modernization becomes sustainable rather than transactional.

Defense Pricing After the Deals: What Actually Improved?

Defense equipment pricing is rarely transparent, but post-framework dynamics are visible. Key changes include:

- Bulk procurement incentives

- Reduced spare-part mark-ups

- Lower lifecycle costs through local maintenance

- Improved availability of components

- Removal of politically inflated pricing

The result is not dramatic price cuts but strategic cost efficiency over decades. That distinction matters more than headline discounts.

Zero-Tariff Export Access: Ground-Level Economic Impact

Recent trade notifications confirmed zero-tariff access to the U.S. for a wide range of Indian products:

- Spices, tea, coffee

- Cashew and coconut derivatives

- Fruits, vegetables, processed foods

This directly affects the Agricultural exporters, Food-processing MSMEs, Rural supply chains Trade benefits here are not abstract—they translate into income stability and employment.

The Tariff Asymmetry Question?

This is the most misunderstood aspect of the U.S. framework and the most important.

Why India Offered 0% Tariffs ?

India’s 0% tariff concessions were selective, not universal. They focused on sectors where:

- Domestic producers face limited competitive threats.

- Imported inputs reduce downstream costs.

- Supply improves food processing and consumer affordability.

In other words, India removed tariffs where it gained efficiency, not vulnerability. Tariffs in these categories were not strategic shields, they were cost layers. Removing them helped Indian value chains as much as American exporters.

Why the U.S. Retained ~18% Tariffs ?

The retained U.S. tariffs reflect American domestic constraints, not Indian negotiating weakness. Factors include:

- Strong protectionist pressure from the U.S. industrial lobbies

- Electoral sensitivities

- Reluctance to rapidly open labor-intensive sectors

India faced a choice: Demand immediate symmetry and prolong uncertainty, or Accept a stable baseline and negotiate downward over time. India accepted 18% as a floor, not a ceiling and also as a pause, not a settlement. With the EU deal completed, India’s leverage in future U.S. negotiations increases. India chose predictability over perfection. A predictable tariff, even if it’s an imperfect one. It offers the exporters greater operational clarity rather than an uncertain or fluctuating trade regime.

Why Is This Asymmetry Strategic and Not Submissive ?

Asymmetry is only a weakness when there are no alternatives. India entered this framework with:

- A concluded EU FTA

- Multiple trade partners

- Defense and energy leverage

- Time on its side

That changes everything. The 18% tariff is not an end state. It is a negotiated floor.

Why India accepted the $500 Bn Commitment ?

The $500 billion figure has been widely and largely misread. Neither it is not a cash transfer nor a giveaway. It represents:

- Long-term imports India would require anyway

- Energy purchases

- Defense procurement

- High-technology inputs

India did not invent this spending. It structured it.

How India Turned Inevitable Spending into Leverage?

Instead of resisting imports, India attached conditions:

- Defense technology access

- Co-production clauses

- Pricing concessions

- Local manufacturing and maintenance

India did not invent this spending. It structured it.

How India Turned Inevitable Spending into Leverage?

Instead of resisting imports, India attached conditions:

- Defense technology access

- Co-production clauses

- Pricing concessions

- Local manufacturing and maintenance

India’s recent trade strategy follows a simple principle: concede tactically, gain structurally.

| Area | What India Conceded | What India Gained |

|---|---|---|

| Tariffs | Selective 0% tariffs in low-risk sectors | Predictable trade terms and leverage for future negotiations |

| Market Access | Wider access to Indian consumer market | Zero-tariff export entry for key agricultural and processed goods |

| Defence Procurement | Long-term import commitments | Technology transfer, co-production, and lifecycle cost control |

| Energy Imports | Continued energy purchases | Tariff relief and strategic autonomy in sourcing |

| Manufacturing | Gradual opening of supply chains | Integration into EU and US value chains |

| Capital Flow | Acceptance of outward expenditure | Inward investment, local manufacturing, and job creation |

| Negotiation Strategy | Acceptance of interim asymmetry | Time advantage and stronger bargaining position |

What could have been passive expenditure became capability acquisition.

Why This Strengthens India Long-Term ?

A large share of this exposure feeds into:

- Defense readiness

- Industrial scaling

- Energy stability

- Technology absorption

India converted consumption into strategic investment, even when money flowed outward.

India’s Strategic Position: Has the Leverage Shifted ?

Several developments illustrate the shift:

- Official U.S. and EU trade maps depicting the entire Jammu & Kashmir region as part of India

- Removal of additional tariffs tied to India’s Russian energy purchases

- A shift from pressure to negotiation

Reported but awaiting official confirmation: Diplomatic sources suggest that the Indian leadership signaled a willingness to wait out unfavorable tactics rather than concede strategic ground.

Who Really Shapes the World Order and Where India Stands?

The underlying message is clear: pressure works only when options are limited. India now has options.

Pros, Cons, and Reality Checks of Mother of All Deals and Bilateral Trade Agreement

| Category | Mother of All Deals | Bilateral Trade Agreement |

|---|---|---|

| Strengths | Long-term certainty Export expansion Investment confidence | Immediate tariff relief Defense technology access Strategic stabilization |

| Challenges | Compliance costsEnvironmental standards | Interim status Agricultural exposure Asymmetrical commitments |

| Response | Gradual adaptation State support for MSMEs Technology upgrading | Safeguards Phased liberalization Negotiating patience |

When taken together, the Mother of All Deals delivers as a long-term structural certainty, while the U.S. Framework functions more as a strategic stabilizer with addressing immediate frictions while keeping the door open for deeper engagement for India.

Strategic Roadmap: What India Should Prioritize?

- Turn Trade Access into Industrial Scale

- Anchor Defence Co-Production

- Protect Farmers Through Design, Not Isolation

- Own the Narrative

- Exploit Time Advantage

It is difficult to ignore a pattern:

- Pressure is policy.

- Compliance is partnership.

- Autonomy is a concern.

India’s recent experience suggests a shift that firmness now invites respect.

Conclusion: What Mother of All Deals and Bilateral Trade Agreement Really Signal?

These agreements are not about choosing Europe over America or trade over defense. They are about India choosing strategic maturity.

- The Mother of All Deals builds structural economic depth.

- The U.S. framework restores balance and unlocks defense capability.

- The tariff asymmetry reflects sequencing, not surrender.

- The $500 billion exposure converts spending into leverage.

India is no longer waiting for validation. It is setting terms. In trade, defense, and diplomacy, India is no longer being evaluated. India is doing the evaluating.

“The test of policy is how it ends, not how it begins.”

Henry Kissinger

Top 4 FAQs: Mother of All Deals vs Bilateral Trade Agreement

A) Yes! As because it goes well beyond tariffs. The India-EU deal is a restructuring of how industries, investments, regulations, and supply chains interact with each other over the long term. It is not a trade boost for a short period of time but a structure that changes the way manufacturing, services, and investments are made for the next several decades, which is why it is so different from other trade agreements.

A) No! The tariff imbalance is intended. India offered lower tariffs in areas where the risk was low and the potential for efficiency gains was high, while also gaining predictability, defense technology, and future bargaining power. A good but not perfect tariff is often better than an unpredictable tariff in international trade.

A) No! It is not a cash transfer or a giveaway. The number represents the long-term imports that India would have to do anyway with energy, military hardware, and high-tech components. The decisive change is that India has formatted this necessary expenditure to get technology transfer, co-production rights, and favourable pricing.

A) Yes! The important shift is just not in the agreements but also in the way they have been negotiated. India has completely defied short-term pressure without sacrificing basic standards and diversified partners and has made trade negotiations strategic leverage. The shift in the global environment from pressure to negotiation indicates that leverage has been substantially enhanced.