(a) Pakistan’s near-term defence-budget picture (what’s happened and why)

- Recent move – Pakistan raised defence spending sharply for FY2025-26 — roughly +20%, taking the defence budget to about PKR 2.55 trillion (~USD 9bn). This was part of a broader FY26 budget where overall spending was cut but defence got a higher share.

- Why – The jump is explicitly linked to increased tensions with India and recent high-intensity border incidents/near-war flashpoints; defence items moved to the top of priorities (replenishment after operations, force readiness, ammunition, air defence and naval modernisation).

- Fiscal constraints & trade-offs – Because the overall budget was tightened, a sustained big increase in defence spending will strain fiscal space and may force reprioritisation of social/development outlays unless economic growth or external funding (from allies) offsets it. Transparency concerns about the composition of defence-related spending have also been raised by external monitors.

- Outlook (what to watch) – If tensions with India remain high or Islamabad deepens defence pacts (see below), expect continued pressure to keep defence allocations elevated for 1–3 years; conversely, a de-escalation or large external financing package could stabilise the fiscal picture.

(b) The “Muslim NATO” / collective Muslim security idea — strategy and realism

- What Islamabad appears to be doing – Pakistan has actively promoted the idea of closer collective security among Muslim states — diplomatic outreach at the Doha summit and public commentary have revived talk of an “Arab/Islamic NATO” or a NATO-like security umbrella among Muslim-majority states, with Pakistan positioning itself as a central security partner. Several recent media analyses tie Pakistan into these discussions.

- Concrete signal – Saudi pact (major development) – In mid-September 2025 Pakistan and Saudi Arabia signed a “Strategic Mutual Defence” pact which states an attack on one will be treated as an attack on both — a significant institutional step toward collective deterrence among Muslim states and a clear demonstration of the sort of bilateral security anchoring that could be a building block for a larger framework. Observers note this also pulls Pakistan’s nuclear deterrent, politically if not formally, into the regional security equation.

- Realism / constraints –

- Political divergence – Muslim-majority states have diverging threat perceptions, relations with external powers (US, Russia, China), and bilateral rivalries (e.g., Pakistan-India, Saudi-Iran, Turkey-Gulf differences). That makes a single, interoperable alliance like NATO hard to replicate.

- Legal/operational hurdles – NATO has long institutional structures, shared command, funding and collective defence doctrine. Any Muslim-bloc would take years to build credible joint command, logistics and burden-sharing.

- Nuclear complications – Pakistan is nuclear-armed; any formal alliance that implies collective defence raises serious proliferation/policy sensitivities (regional backlash, escalation risks). Analysts flag that even recent Saudi-Pakistan steps leave ambiguous the formal role of nuclear weapons.

- Pakistan’s strategy is to use bilateral pacts (e.g., with Saudi Arabia), defence diplomacy (Turkey, China, Russia), and export/co-production offers to weave a network of security ties that could evolve into a looser NATO-style security architecture — but a formal, NATO-equivalent alliance across many Muslim states remains politically and technically unlikely in the short term. The recent Saudi pact, however, is a major forward step toward deeper collective defence arrangements in the region.

(c) Major defence acquisitions and partner relationships (what Pakistan is buying / being offered now)

China — largest and deepest supplier

- (a) Pakistan’s near-term defence-budget picture (what’s happened and why)

- (b) The “Muslim NATO” / collective Muslim security idea — strategy and realism

- (c) Major defence acquisitions and partner relationships (what Pakistan is buying / being offered now)

- Timeline + table — reported Pakistan defence acquisition deals (buyer / seller, value, status, likely delivery window)

- Strategic Dynamics Timeline (2025–2028)

- 2. Timeline of Likely Impacts

- Positive Repercussions

- Negative Repercussions

- Repercussions for India

- What Stance India Should Take

- Iran–Saudi–Pakistan Tensions – Likely Repercussions

- Repercussions for Israel

- Looking Ahead – Projecting Air Power by 2030

- Recent Developments

- Conclusion Statement / Position for India:

- Air – Reports that China offered advanced aircraft (J-35/FC-31) to Pakistan and there are repeated media reports of deals/offers (also Pakistan–China cooperation on fighter jets and co-development historically). Pakistan continues co-operation on the JF-17 and Pakistan Aeronautical Complex remains engaged in production/export of JF-17 variants.

- Naval – Acquisition/induction of Type-054A/P frigates built in China — Pakistan has received multiple Type-054A/P frigates under a multi-ship programme.

- Air-defence / AWACS / missiles – Public reporting lists offers/possible procurements such as KJ-500 AWACS and HQ-19 air-defence systems in press coverage of Chinese offers.

- Other – Long-standing supply of tanks (Al-Khalid/VT-4), submarines and missiles; China is Pakistan’s strategic anchor for conventional rearmament.

Turkey — drones, munitions, and growing defence cooperation

- Drones/UCAVs – Pakistan has been reported as procuring or planning to procure Turkish MALE/UCAV systems (Bayraktar TB2 series, Akinci and related systems) and partnering on drones and munitions. Several recent pieces reference multi-hundred-million-dollar drone/munition deals and revisions to those deals.

- Missiles / cruise missiles – Open-source reporting has also linked Turkish companies (e.g., Baykar) with missile/cruise-munition sales to Pakistan.

Russia — warming ties, exercise cooperation, selective kit

- High-level cooperation & exercises – Pakistan and Russia have broadened cooperation (exercises, diplomacy) and discuss multidimensional partnership; but large, transformational Russian sales (e.g., S-400) are not publicly confirmed as concluded. Russia remains a partner for some training, spares, and political signalling.

Exports / third-party business (Pakistan as seller)

- JF-17 exports – Pakistan has secured export orders for the JF-17 (the Azerbaijan order reported for 40 aircraft is the biggest publicised Pakistan export deal recently). Exports keep Pakistan’s aerospace industry in the market and are geopolitically significant.

Gulf partners and defence pacts (Saudi Arabia prominent)

- Saudi-Pakistan “Strategic Mutual Defence” pact (Sept 2025) — Institutionalises a closer defence relationship and may include training, basing, joint exercises, cooperation on deterrence. This is both a political and security signal that influences procurement/deterrence choices.

Strategic implications (short analysis)

- Regional arms-balance effect – Higher Pakistani defence spending + major Chinese/Turkish deliveries will keep pressure on India to respond; this fuels an arms spiral risk in South Asia.

- Alliance reshaping – Pakistan’s bilateral pacts (especially the Saudi pact) and outreach to other Muslim states could create a hub-and-spoke security network rather than a fully institutionalised NATO replica — meaningful politically and militarily, but limited by diverging interests among Muslim states.

- Fiscal strain vs readiness – Raising defence spending while overall budgets are cut risks long-term economic strain unless balanced by external financing (Gulf/China) or higher growth; procurement choices may therefore favour cheaper/high-impact systems (drones, missiles, localized production/co-production).

Timeline + table — reported Pakistan defence acquisition deals (buyer / seller, value, status, likely delivery window)

Below I built a compact chronological timeline followed by a table you can copy into a brief.

Timeline (key public milestones)

- 2015 (contract) — Pakistan and China agree a programme for 8 Hangor-class (Type-039A export) submarines (mixed China-built and local construction under tech-transfer).

- 2018 (contract) — China–Pakistan four-ship contract for Type-054A/P frigates (Tughril class); deliveries completed in batches, final frigates commissioned by May 2023.

- Mar 16, 2025 — Chinese shipyard completed the 2nd Hangor-class submarine for Pakistan (project ongoing; more units launched/under construction).

- Jun 6, 2025 — Pakistan government announced a $4.6 billion defence agreement to supply 40 JF-17 fighter jets to Azerbaijan (largest Pakistan defence export reported).

- Early–June 2025 — Multiple outlets reported China offered Pakistan a package including 40 J-35 (FC-31) stealth fighters, KJ-500 AEW&C aircraft and HQ-19 theatre air-defence systems; reporting flagged these as offers/ongoing talks, while some Pakistani officials later downplayed or denied signed purchase agreements. Status = offer / under discussion / disputed.

- 2023–2025 (ongoing deliveries / local production) — Chinese VT-4 / Al-Khalid tank deliveries and local assembly programmes reported earlier (large numbers reported historically; spares and components deliveries continued into 2024–25).

- Dec 2024 – 2025 (reports) — Pakistani press / defence outlets list Turkish MALE/UCAV systems (Bayraktar TB2 / Akinci) and munitions on PAF procurement Wishlist’s; status – reported procurement plans / negotiation (no clear public contract signature reported in mainstream wire services).

- 17 Sept 2025 — Pakistan and Saudi Arabia sign the “Strategic Mutual Defence Agreement” (treat an attack on one as an attack on both). Not a procurement, but major strategic development affecting future acquisitions and basing/maintenance/cooperation.

Table — reported acquisition / defence deals (concise view)

| Date (pub./announced) | Buyer / Recipient | Seller / Supplier | Item (short) | Reported value (USD) | Public status (what sources say) | Likely delivery window (public reporting / estimate) |

| 2015 (contract) → ongoing | Pakistan Navy | China (CSIC/CSSC + KSEW) | 8 Hangor-class subs (Type-039A export variant) | ~$4–5 bn (projected contract value reported earlier) | Contracted; several boats launched/being delivered; tech-transfer to build later boats in Pakistan. | First China-built boats launched 2024–2025; remaining Pakistan-built units due 2025–2028 (per original schedule). |

| 2018 (order) → delivered by 2023 | Pakistan Navy | China (CSSC) | Type-054A/P frigates (Tughril class) — 4 ships | Not publicly disclosed per ship in dependable open sources (commercial estimates vary) | Contract awarded and deliveries completed (final ships commissioned May 2023). | Delivered/commissioned (2019–May 2023). |

| Mar 16, 2025 (launch/completion) | Pakistan Navy | China | 2nd Hangor submarine completed / launched (continuing programme) | Part of the 2015 programme (~$4–5bn total) | Shipyard completed second hull; programme ongoing. | Ongoing deliveries through mid-2020s; subsequent hulls to be completed per schedule. |

| 2023 (reported contract/production) | Pakistan Army / Army Production | China (NORINCO, etc.) | VT-4 / Al-Khalid tanks — local assembly & components; spares | Historical reporting – large batch (e.g., 679 units reported in open sources) — commercial estimates vary | Contract/production and local assembly reported; follow-on deliveries and parts shipments continued. | Ongoing assembly/induction since 2023; parts deliveries through 2024–25. |

| Jun 6, 2025 (announcement) | Azerbaijan (buyer) | Pakistan (PAC / Pakistan Govt.) (seller) | 40 JF-17 Block III fighter jets (Pakistani export) | ~$4.6 billion (deal reported publicly) | Deal announced by Pakistan (government X post); described as largest Pakistan export deal — apparently signed. | Delivery timeline not fully public; typical production + delivery might span 2025–2028 depending on production capacity. |

| Early Jun 2025 (reported offer) | Pakistan AF (potential buyer) | China (PLAAF / PRC industry) | J-35 (FC-31) stealth fighters; KJ-500 AEW&C; HQ-19 AD system (package offer) | Individual system values not publicly listed; HQ-19/KJ-500/J-35 would be multi-billion USD if procured | Multiple outlets reported an offer / proposed package and formal talks; Pakistan later had mixed/contradictory official statements (some denials/clarifications). Status = offer / talks / disputed. | If contracted, deliveries of complex systems could stretch 2–6 years (J-35/AWACS/AD), but public reporting emphasises uncertainty/denials. |

| Dec 2024 – 2025 (reports/wishlist) | Pakistan AF / Army (potential buyer) | Turkey (Baykar / Turkish defence industry) | Bayraktar TB2 / Akinci (MALE / UCAV) drones; munitions & collaboration | Reported as multi-million to low-hundreds-million USD deals depending on scale; no firm public price | Open-source / local reports list Turkish drones on PAF wishlist and procurement planning; mainstream wire reports of firm contract are limited — status = reported/negotiation / probable purchases. | If contracted, deliveries typical in 6–24 months after contract signature. |

| Ongoing (2024–25 reporting) | Pakistan AF / Defence | China (NORINCO, other firms) | KJ-500 AEW&C (talks/offer) | Not published | Negotiations / offers reported; some outlets report formal talks underway — status = negotiation / offer (not publicly confirmed as signed). | AEW&C procurement and induction usually 1–3 years post contract; reporting uncertain. |

| Jun 2025 reporting / other | Pakistan (air defence) | China / other suppliers | HQ-19 (theatre missile defence) (offer/interest) | Not published | Reported as offered by China and Pakistan expressing interest; status = offer / consideration. | Complex AD systems take years to integrate — multi-year delivery window if contracted. |

| Sep 17, 2025 (strategic pact) | Pakistan & Saudi Arabia (security partners) | N/A (defence pact) | Strategic Mutual Defence Agreement — mutual defence clause | N/A (political/security pact) | Signed; not a hardware acquisition but will influence future joint logistics, basing, training and possible arms/maintenance support. | Immediate strategic effect; hardware cooperation timelines depend on follow-on MoUs. |

Short notes on reliability / interpretation

- “Offer” vs “contract” — several of the largest headlines (J-35, KJ-500, HQ-19) are offers/negotiations reported widely in June 2025; Pakistani officials have given mixed signals and some denials/clarifications followed, so treat those as potential / under discussion until formal contract signatures and delivery timelines are confirmed.

- JF-17 → Azerbaijan deal is the highest-profile signed export reported publicly (government announcement June 2025). Delivery scheduling details were not published in depth in initial announcements.

- China remains the dominant hardware supplier (frigates, submarines, tanks, and offers of advanced systems). Turkey is an important near-term partner for drones and munitions; Gulf states (Saudi) are now formalising deeper security ties that will affect future acquisitions/support.

The Pakistan–Saudi “Strategic Mutual Defence Agreement” (Sept 17, 2025) is historic — first time Riyadh has signed a treaty-level pact with mutual defence language outside its US security umbrella. Here’s a structured analysis of global repercussions — positive and negative — for the defence community

Strategic Dynamics Timeline (2025–2028)

1. Key Players

- Pakistan – Military capability, nuclear deterrent, regional leverage.

- Saudi Arabia – Financial resources, geopolitical influence, Gulf security.

- Iran – Regional competitor, perceives encirclement.

- India – Observes Pakistan-Saudi alignment; recalibrates defense posture.

- Turkey – Strengthens defense ties with Pakistan (KAAN jets).

- US/NATO & EU – Observes regional balance; engages diplomatically.

2. Timeline of Likely Impacts

| Year | Pakistan–Saudi Pact Impacts | Regional Response | Global/Strategic Outcome |

| 2025 | SMDA signed; joint military exercises planned; rapid defense coordination protocols established. | Iran expresses concern; India monitors for escalation; Turkey strengthens defense cooperation with Pakistan. | Signals Sunni-aligned strategic bloc; Saudi Arabia reassures Gulf allies. |

| 2026 | Joint training, intelligence sharing, and arms procurement commence. Pakistan begins integrating Saudi-funded modernization programs. | Iran accelerates missile and nuclear programs; India boosts air defense and regional alliances. | Regional militarization increases; deterrence posture strengthens on both sides. |

| 2027 | Co-development of defense systems, drones, or surveillance platforms explored. Pakistani military capability visibly enhanced. | Gulf states encouraged to align with Saudi-Pakistan axis; Iran pursues counter-alliances with Russia/China. | Pakistan emerges as a credible regional power; Saudi influence in South Asia grows. |

| 2028 | Operational integration of select Saudi-Pakistani military capabilities; possible rapid response framework tested. | India re-evaluates military deployments along western borders; Iran focuses on strategic depth elsewhere. | Clear shift in power projection; Pakistan is seen as a strategic partner capable of extending influence beyond its borders. |

3. Key Takeaways

- Deterrence & Signalling – The pact sends a clear message to Iran, India, and other regional actors that Pakistan-Saudi collaboration is formal and operational.

- Strategic Autonomy – Pakistan gains both military and economic leverage.

- Regional Polarization – Sunni-majority alliance vs. Iran-led axis becomes more distinct.

- Global Watch – US, EU, and NATO monitor the balance of power, especially Pakistan’s growing ties with Saudi Arabia and Turkey.

Positive Repercussions

The SMDA is open to other Arab nations, and Egypt’s active engagement in regional defense initiatives suggests a possibility of future collaboration. The evolving security landscape and Egypt’s strategic interests may lead to deeper defense ties with Pakistan and Saudi Arabia in the coming years.

- Strengthened Gulf deterrence posture

- Saudi Arabia gains a credible, nuclear-armed partner in Pakistan. Even if nukes are not formally covered, the political signal is strong.

- This enhances Saudi bargaining power against Iran and other rivals.

- Diversification of defence partnerships

- Riyadh reduces sole dependence on the US, signalling to Washington and Europe that it has alternatives.

- For Pakistan, this means diversified funding and strategic depth beyond China.

- Boost to defence industry cooperation

- Expect co-production projects (munitions, drones, maintenance hubs in Saudi) and joint training centres in the Gulf.

- Opens export opportunities for Pakistan (JF-17, drones, tanks) funded by Saudi capital.

- Foundation of an “Islamic security bloc”

- This bilateral pact could seed a looser NATO-style Muslim coalition — encouraging Turkey, UAE, Qatar, and Egypt to formalise defence ties.

- Could reshape collective security in the Islamic world.

- Arms market diversification

- Greater purchases from China, Turkey, Pakistan, reducing monopoly of Western suppliers in the Gulf.

- New competition could lower costs and accelerate tech transfer deals globally.

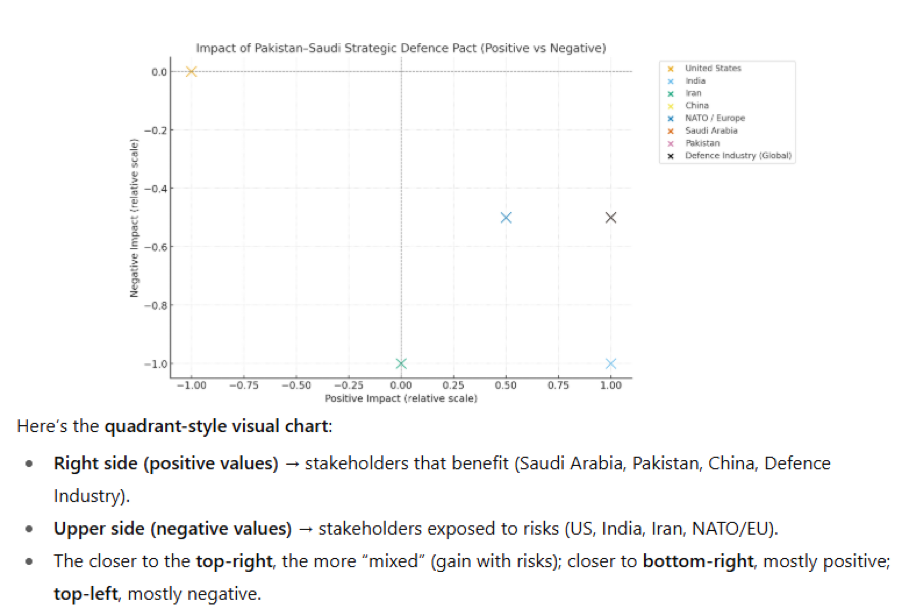

Negative Repercussions

- Iran–Saudi–Pakistan tensions

- Tehran will perceive this as encirclement and may accelerate nuclear/ballistic missile programmes.

- Increases regional polarisation (Sunni bloc vs. Iran-led axis).

- US & Western unease

- Washington sees its primacy in the Gulf diluted.

- Concerns over nuclear ambiguity – Does the pact give Saudi indirect access to Pakistan’s nuclear umbrella? This raises non-proliferation alarm in NATO capitals.

- India’s strategic anxiety

- India views a Saudi–Pakistan mutual defence pact as strengthening Islamabad’s hand.

- Could push New Delhi to deepen defence ties with US, France, Israel, and expand its Gulf outreach to counterbalance.

- Arms race risk in South Asia rises.

- Fragmentation of global arms alliances

- Western defence companies risk losing big contracts in Saudi Arabia if Riyadh shifts more deals to Pakistan, China, and Turkey.

- May fuel parallel defence ecosystems (Western vs. China–Turkey–Pakistan bloc).

- Risk of escalation in proxy conflicts

- If Riyadh and Islamabad coordinate closely, Saudi funding could enable Pakistani equipment to appear more widely in conflicts (Yemen, Horn of Africa, etc.), alarming international monitors.

Big-Picture Impact on the Defence Community

- Multipolarity deepens – US/NATO no longer sole security guarantors in the Gulf. China, Turkey, and Pakistan gain weight.

- Nuclear proliferation debates sharpen – The line between “conventional defence pact” and “nuclear umbrella” is blurry, inviting scrutiny from IAEA, NPT members, and think-tanks.

- Arms trade realignment – Expect greater Chinese and Turkish defence penetration in Gulf markets, often through Pakistan as the bridge.

- Alliance reshaping – Moves toward regional blocs (India–US–Israel alignment vs. Saudi–Pakistan–Turkey–China cluster) become more likely.

This pact is a geopolitical earthquake for defence communities –

- Positive — stronger Gulf deterrence, new defence-industrial collaborations, multipolar balancing.

- Negative — nuclear ambiguity, regional arms race, strained US–Saudi ties, sharper Iran–Saudi–Pakistan tensions.

It marks the start of Pakistan acting as a security exporter, not just importer, with Riyadh as its strongest Arab ally.

Repercussions for India

1. Security & Strategic Concerns

- Enhanced Pakistani leverage – Islamabad now has formal Saudi backing; any Indo–Pak escalation could politically draw in Riyadh.

- Indirect nuclear ambiguity – Even if unofficial, India may perceive Saudi Arabia as enjoying an implicit Pakistani nuclear umbrella. This sharpens India’s threat calculus.

- Two-front challenge risk – The pact, combined with China’s strategic alignment with Pakistan, creates the impression of a triangular bloc (China–Pakistan–Saudi), complicating India’s defence posture.

2. Regional Balance & Gulf Dynamics

- Reduced Indian sway in Riyadh – India has built strong economic/energy ties with Saudi Arabia. A formal Saudi–Pakistan military pact dilutes New Delhi’s ability to leverage Gulf partnerships.

- Iran factor – India’s ties with Iran (e.g., Chabahar Port) could be pressured if Riyadh–Islamabad bloc positions itself directly against Tehran. This may force India to balance both Gulf camps carefully.

3. Defence Industry Implications

- Saudi defence procurement could increasingly favour Pakistan/China/Turkey systems, squeezing Indian opportunities for exports, joint ventures, and training.

- Raises the urgency for India to expand defence exports beyond South Asia (Africa, Southeast Asia).

4. Diplomatic & Geopolitical Impact

- US factor – Washington may view the Saudi–Pakistan pact as a weakening of US leverage in the Gulf. India could find common ground with the US to jointly manage Gulf security and curtail Pakistani influence.

- OIC (Organisation of Islamic Cooperation) – Pakistan may use this pact to push anti-India narratives within OIC forums, possibly harder than before.

What Stance India Should Take

(a) Strengthen Bilateral Ties with Gulf Powers

- Deepen India–Saudi economic interdependence – Position India as indispensable in energy trade, infrastructure, and technology (beyond oil imports).

- Elevate defence ties with UAE & Oman – Expand joint training, intelligence-sharing, and logistics agreements — creating a counterweight to Pakistan within the Gulf.

- Offer Saudi Arabia non-military security cooperation (e.g., cyber, space, counter-terrorism) to keep Riyadh invested in India despite its pact with Pakistan.

(b) Bolster Strategic Partnerships

- Accelerate Indo–US–Israel defence trilateral in missile defence, drones, cyber, and intelligence.

- Intensify cooperation with France (aircraft, submarines, Rafale-M for Navy) to demonstrate technological edge over Pakistani acquisitions.

(c). Diplomatic Counterbalance

- Quiet engagement with Iran – Use Chabahar Port and energy links to hedge against a Sunni-bloc consolidation.

- Multi-vector diplomacy – Position India as a balancer rather than a partisan actor — working with both Saudi Arabia and Iran on stability narratives.

(d) Military Posture

- Accelerate indigenous deterrence programmes (long-range SAMs, missile defence, stealth UAVs).

- Upgrade naval deployments in the Arabian Sea to counter potential Pakistan–Saudi joint maritime drills.

- Strengthen intelligence operations in the Gulf to track Pakistan’s deployments, training, and basing access.

E. Narrative & Soft Power

- Reinforce India’s diaspora leverage in the Gulf (9+ million Indians in GCC) as an economic stabiliser.

- Shape the narrative that India is a reliable, non-sectarian partner, unlike Pakistan’s bloc-driven approach.

Summary for India

The pact heightens the two-front security challenge for New Delhi (China + Pakistan, now with Saudi support). India should respond with a layered strategy – deepen Gulf partnerships, double down on US/EU/Israel defence ties, hedge with Iran, and accelerate indigenous military modernisation.

Iran–Saudi–Pakistan Tensions – Likely Repercussions

1. Perception of Encirclement (Tehran’s View)

- Iran sees this as formalisation of Sunni bloc alignment — Saudi (wealth + influence) + Pakistan (military + nuclear) encircling Iran.

- Expect Tehran to accelerate nuclear and ballistic missile programmes to restore deterrence credibility.

- May push Iran to reduce ambiguity and openly showcase missile range upgrades, MIRV testing, or hypersonic claims.

2. Regional Polarisation

- Pact deepens Sunni vs. Shia security divide –

- Sunni bloc – Saudi, Pakistan, UAE (likely sympathetic), Turkey (partial).

- Shia axis – Iran, Iraq militias, Syria (Assad), Hezbollah, Houthis in Yemen.

- Proxy conflict zones (Yemen, Iraq, Syria, Lebanon) could see fresh escalations, with Pakistani training or Saudi finance countering Iranian-backed militias.

3. Risk of Escalatory Spiral

- Iran may harden ties with Russia & China — seeking counter-leverage against Riyadh/Islamabad.

- Covert retaliation – Cyber-attacks on Saudi oil infra (Aramco), maritime harassment in Hormuz, or asymmetric strikes through proxies.

- Increases likelihood of maritime insecurity in the Arabian Sea and Gulf of Oman, directly impacting global energy flows.

4. Implications for Pakistan

- Pakistan risks being dragged into Saudi–Iran rivalry militarily. If Riyadh faces Iranian-backed threats, Islamabad may be obligated to commit forces, complicating its already fragile economic/military bandwidth.

- Tehran could turn up covert pressure inside Balochistan as a response, fuelling instability in Pakistan’s west.

5. Implications for Global Community

- Nuclear ambiguity – Fears that Pakistani nuclear assets might extend to Saudi’s security umbrella will alarm the West, India, and Israel.

- OPEC+ divisions – Polarisation may spill into energy diplomacy, fragmenting cooperation with Russia/Iran vs. Saudi/GCC.

- Increased arms race in Middle East – Israel, Turkey, and Gulf states will accelerate acquisitions of missile defence and UAV systems.

To Watch

- Iranian military drills showcasing new missile ranges.

- Iran–Russia defence technology exchanges (e.g., Su-35, S-400, hypersonic).

- Proxy escalations (Yemen/Hormuz naval activity).

- Pakistan’s balancing acts – whether it quietly reassures Tehran, or doubles down on Riyadh.

Repercussions for Israel

1. Security Threat Perceptions

- Pakistan’s nuclear capability tied to Saudi Arabia raises alarm in Tel Aviv — Israel views any expansion of a nuclear umbrella in the Middle East as existential.

- Potential Iranian acceleration of nuclear and missile programmes (to counter the Saudi–Pakistan pact) increases direct threats to Israel.

2. Strategic Calculations

- Israel will tighten alignment with India, UAE, and the US to contain both Iranian escalation and Pakistan–Saudi linkages.

- Strengthening the Abraham Accords network (UAE, Bahrain, Morocco, potentially Saudi Arabia if balances with the pact) becomes more urgent.

3. Military/Operational Impact

- Boost for missile defence programmes (Arrow-4, Iron Dome upgrades, David’s Sling) as Israel anticipates a more missile-heavy regional future.

- Potential intelligence ramp-up on Pakistan — historically Israel has focused more on Iran, but this pact may pull Pakistani nuclear dynamics into Israeli threat assessments.

4. Diplomatic Dimension

- Israel may quietly encourage the US and EU to pressure Riyadh to avoid nuclear ambiguity.

- Could also exploit Gulf divisions — working with UAE and Oman to limit Saudi’s strategic tilt toward Pakistan.

Repercussions for Europe/NATO

1. Strategic Concerns

- Fear of nuclear proliferation – A Saudi–Pakistan defence pact suggests Riyadh might eventually demand access to nuclear deterrence, undermining the Non-Proliferation Treaty (NPT).

- Middle East instability spillover – escalation between Saudi–Pakistan bloc vs. Iran could spark refugee flows, energy price spikes, and terrorism risks that hit Europe directly.

2. Energy Security Risks

- Europe still depends on Gulf energy (especially after cutting Russian gas post-Ukraine war). Any Saudi–Iran–Pakistan tension that destabilises Hormuz shipping threatens European energy supply and prices.

3. Defence/Industry Impact

- European defence exporters (France, UK, Italy, Germany) risk losing Gulf contracts to Chinese, Turkish, and Pakistani suppliers.

- May push Europe to double down on partnerships with UAE, Qatar, and India as counter-balancing arms markets.

4. Political & NATO Dynamics

- NATO fears being bypassed – if a Muslim “NATO-like bloc” consolidates under Pakistan–Saudi leadership, it challenges Western-led security frameworks.

- EU and NATO may see this as an opening for Russian and Chinese influence to deepen in the Middle East.

5. Counter-strategies

- Likely expansion of Euro-Israeli defence collaboration (missile defence, UAVs, space-based ISR).

- Enhanced NATO maritime patrols in the Mediterranean/Red Sea to safeguard trade routes.

Summary –

- For Israel – existential worries about nuclear ambiguity, accelerated missile defence, tighter US–India–UAE coordination.

- For Europe/NATO – nuclear proliferation fears, energy insecurity, defence industry losses, and the challenge of an alternative Muslim-led bloc weakening Western influence.

Timeline Framework

1. Short-Term (2025–2026)

- Focus – Immediate reactions and tactical moves following the Pakistan–Saudi defence pact announcement.

- Typical actions – Official statements, diplomatic engagements, preliminary sanctions or support, intelligence assessments, minor military deployments, and early arms or tech deals.

2. Medium-Term (2026–2027)

- Focus – Strategic adjustments, coalition-building, and policy recalibration.

- Typical actions – Defense agreements, joint exercises, technology transfers, supply chain adjustments, counterbalancing regional partnerships, soft power initiatives.

3. Longer-Term (2027–2028)

- Focus – Institutionalizing alliances, regional power shifts, and major capability developments.

- Typical actions – Permanent basing agreements, integrated defense systems, nuclear/missile posture changes, full deployment of EW/surveillance assets, formalized trade/military sanctions or incentives.

Example Stakeholder Mapping on the Timeline

| Stakeholder | 2025–2026 (Short-Term) | 2026–2027 (Medium-Term) | 2027–2028 (Longer-Term) | Key Risks/Mitigations |

| Israel | Public condemnation, intelligence sharing with allies, monitoring regional arms flows | Lobbying EU/NATO, enhancing missile defense systems, deepening ties with India | Full integration of regional EW and missile defense, possible covert ops | Risk – escalation with Pakistan/Saudi; Mitigation – early warning systems, diplomatic backchannels |

| France | Diplomatic notes, reassessment of Gulf cooperation, initial arms export reviews | Increase military exercises with India & GCC partners, leverage EU diplomacy | Potential permanent presence in strategic Gulf locations, formal defense agreements | Risk – overstretching EU commitments; Mitigation – strategic prioritization |

| UK | Statements of concern, intelligence coordination, modest arms sales realignment | Strengthen NATO/UK-Gulf cooperation, counterbalance via arms/training | Deployment of rapid response units, formalized intelligence-sharing frameworks | Risk – pushback from Pakistan/Saudi; Mitigation – nuanced public messaging |

| Germany | Cautious diplomatic messaging, internal EU consultations | Promote multilateral risk management via EU/NATO, arms policy recalibration | Establish long-term EU-Gulf security initiatives | Risk – domestic political pressure; Mitigation – EU consensus-building |

| NATO/EU | Joint communiqués, threat assessment, readiness exercises | Enhanced joint operations with member states in Indo-Pacific/Middle East, sanctions frameworks | Integrated regional surveillance, cyber/EW coordination, formalized strategic partnerships | Risk – fragmentation among members; Mitigation – unified strategic vision |

This development signals a significant shift in Pakistan’s defense and geopolitical posture

1. Strategic Significance for Pakistan

- Leap in technological capability – Co-producing Turkey’s KAAN 5th-generation stealth fighter is a major step up from the JF-17 (4th-generation/multirole). It places Pakistan among a small group of countries capable of producing cutting-edge stealth aircraft.

- Defense self-reliance – Local production reduces dependency on foreign suppliers for critical fighter jets, ensuring operational autonomy.

- Enhanced deterrence – Stealth capabilities provide Pakistan an advanced air superiority edge in the region, potentially affecting the balance with India and other neighbours.

2. Partnership Dynamics

- With Turkey – KAAN jets involve 5th-generation stealth, avionics, sensor fusion, and potentially AI-driven combat systems. Turkey gains a strategic ally and market expansion; Pakistan gains advanced tech.

- With China – The ongoing JF-17 program strengthens tactical air fleet and provides intermediate technological learning. Pakistan now balances partnerships with two major defense producers.

3. Implications for Regional Security

- India-Pakistan dynamic – This may accelerate India’s own fighter programs, including the Tejas and its 5th-gen AMCA project. Air power competition intensifies in South Asia.

- China-India-Pakistan triangle – Pakistan’s ties with China and Turkey strengthen its regional leverage. Turkey’s involvement adds a NATO-linked strategic dimension, which could influence regional geopolitics.

- Middle East nexus – Turkey-Pakistan defense cooperation may encourage similar collaboration in other sectors (drones, missile systems), signalling a Sunni bloc technological alignment.

4. Technological & Industrial Impact

- Skill development – Pakistan’s aerospace engineers and technicians will gain exposure to stealth design, composite materials, and avionics systems.

- Defense-industrial base growth – Local production creates high-tech jobs, R&D capabilities, and potential for exports to allied countries.

- Transition to advanced fighter production – From JF-17 (mostly conventional) to KAAN (stealth + networked warfare), Pakistan’s aerospace industry is moving up the ladder quickly.

5. Strategic Messaging

- Pakistan is positioning itself as a technology-driven military power, signalling to allies and rivals that it can independently produce high-end defense systems.

- This also increases bargaining power in international defense diplomacy, potentially attracting more defense partnerships and foreign investments.

In short, Pakistan is not just producing jets—it’s entering the league of countries capable of designing, producing, and integrating 5th-generation stealth fighters, alongside China, Turkey, the US, Russia, and a few European nations.

Looking Ahead – Projecting Air Power by 2030

| Country | Air Power Composition (2025) | Projected Air Power (2030) |

| Pakistan | JF-17 Thunder, F-16, Mirage III | JF-17 Thunder, KAAN, F-16, Mirage III |

| India | Su-30MKI, Tejas, Rafale | Su-30MKI, Tejas, Rafale, AMCA (5th-gen) |

| China | J-10, J-20, J-16 | J-10, J-20, J-16, FC-31 (5th-gen) |

| Turkey | F-16, F-4 Phantom | F-16, KAAN (5th-gen) |

By 2030, Pakistan’s air power is expected to be more diversified and technologically advanced, with the integration of the KAAN enhancing its strategic capabilities.

Recent Developments

- Indonesia’s Order for KAAN Jets – Indonesia has signed a $10 billion deal with Turkey to purchase 48 KAAN fighter jets, marking Turkey’s entry into the global fifth-generation fighter market.

- Pakistan’s Participation in KAAN Production – Pakistan’s involvement in the KAAN production signifies a deepening defense collaboration with Turkey, focusing on advanced aerospace technologies.

Conclusion Statement / Position for India:

International Reactions

United States

The U.S. has expressed concern over the pact, particularly regarding the potential extension of Pakistan’s nuclear deterrent to Saudi Arabia. While the agreement does not explicitly mention nuclear cooperation, Pakistan’s Defense Minister Khawaja Asif indicated that Pakistan’s nuclear capabilities could be made available to Saudi Arabia if needed. This development has prompted discussions about the implications for regional security and the U.S.’s role in Gulf defense arrangements.

Israel

Israel views the agreement with apprehension, as it potentially alters the strategic balance in the Middle East. The prospect of a nuclear-capable Pakistan providing a deterrent to Saudi Arabia could influence Israel’s security calculus, especially concerning its own nuclear capabilities and regional alliances.

Iran

Iran perceives the pact as a strategic alignment between Pakistan and Saudi Arabia, two key regional players with significant influence. The mutual defense commitment may alter the regional power dynamics, prompting Iran to reassess its security and diplomatic strategies.

China

China has maintained a neutral stance, focusing on its bilateral relations with both Pakistan and Saudi Arabia. While the agreement may impact regional alignments, China’s primary interest lies in maintaining stable and cooperative relationships with these nations, particularly in areas of economic and infrastructural development.

European Union

The EU has expressed interest in the implications of the SMDA for regional stability and non-proliferation efforts. European officials are monitoring the situation closely, emphasizing the need for dialogue and diplomatic engagement to address any potential security concerns arising from the pact.

Strategic Implications

The SMDA signifies a deepening of military ties between Pakistan and Saudi Arabia, with a mutual commitment to defend each other against external aggression. While the agreement does not explicitly mention nuclear cooperation, Pakistan’s defense minister’s comments suggest that its nuclear capabilities could be extended to Saudi Arabia under certain circumstances. This development has significant implications for regional security dynamics, potentially influencing defense strategies and alliances in the Middle East and South Asia.

India acknowledges the signing of the Pakistan–Saudi Strategic Mutual Defence Agreement. While it reflects the sovereign choices of Pakistan and Saudi Arabia in strengthening their bilateral defense cooperation, India’s security and strategic interests remain robust and unaffected. India continues to maintain strong defense preparedness and diplomatic engagement across the region, focused on promoting peace, stability, and constructive cooperation. The agreement does not alter India’s established regional posture or its commitment to safeguarding its national security.